Fund Your Dream Destination Wedding — Without the Debt

Introducing WeddingRSP — Canada's smart, CRA-compliant way to turn retirement savings into wedding memories without compromising your financial future.

Make 'I Do' a Tax-Smart Move

WeddingRSP is a revolutionary program that lets Canadian couples and their families use RRSPs — without penalty — to fund destination weddings. Whether you're a parent helping your child marry well, or a high-income couple with savings in place, this strategy unlocks funding in a completely CRA-aligned way.

How WeddingRSP Works

Contribute or Leverage RRSP

Use unused contribution room or access RRSP-backed financing through our exclusive financial partners. Our advisors help maximize your available resources without disrupting your retirement goals.

Celebrate Without Sacrificing Retirement

You get the destination wedding of your dreams while your RRSP keeps growing. Our structured approach ensures your retirement savings remain intact and continue accumulating value.

Get Immediate Tax Refund or Smart Loan

Reduce your tax bill or access funds without a traditional loan. Our approach leverages Canada's tax code to your advantage, creating immediate liquidity for your celebration.

Contribute or Leverage RRSP

Use unused contribution room or access RRSP-backed financing through our exclusive financial partners. Our advisors help maximize your available resources without disrupting your retirement goals.

Get Immediate Tax Refund or Smart Loan

Reduce your tax bill or access funds without a traditional loan. Our approach leverages Canada's tax code to your advantage, creating immediate liquidity for your celebration.

Celebrate Without Sacrificing Retirement

You get the destination wedding of your dreams while your RRSP keeps growing. Our structured approach ensures your retirement savings remain intact and continue accumulating value.

Perfect For These Situations

Parents Who Want to Help

Support your child's wedding dreams while protecting your savings. Our approach allows you to contribute meaningfully without compromising your retirement security or dipping into savings or emergency funds.

Couples with Good Income

Perfect for professionals with strong earnings but limited liquid cash. Access your RRSP's power without withdrawal penalties, spreading the cost over time while maintaining your retirement trajectory.

Smart Financial Planners

Ideal for clients who value financial efficiency. WeddingRSP offers a sophisticated alternative to high-interest loans or depleting savings, preserving financial stability while funding your celebration.

Client Success Stories

More From Our Clients

"I helped my daughter get married in Jamaica without touching my TFSA or taking out a high interest loan. The WeddingRSP strategy was brilliant—I maintained my retirement timeline while giving her the wedding she deserved."

— Michael, Vancouver

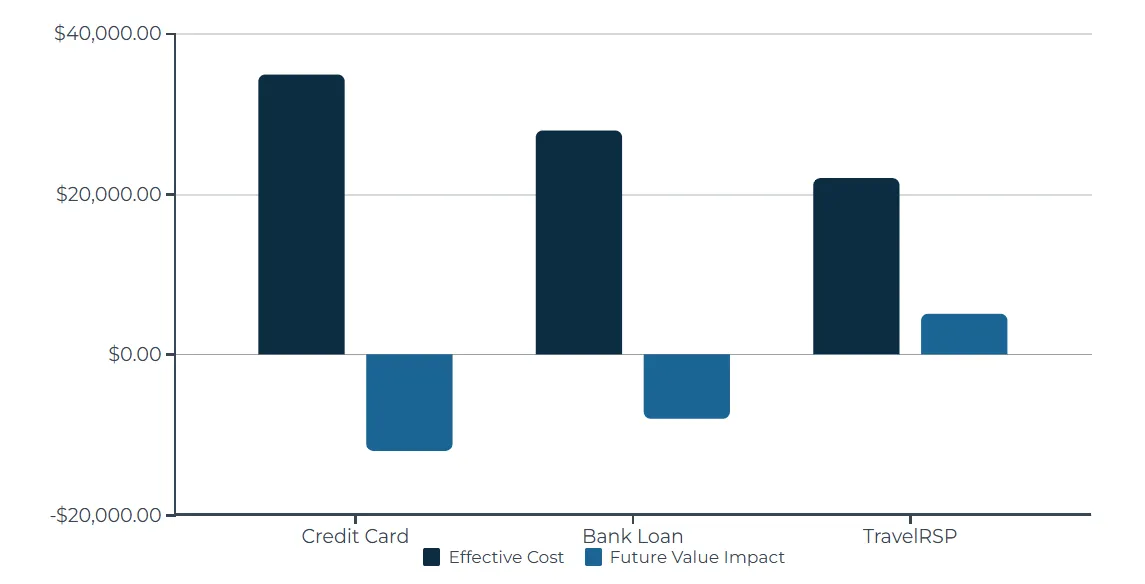

The Financial Advantage

WeddingRSP offers the lowest effective cost for your destination wedding while actually increasing your retirement savings' future value. Traditional funding methods result in higher costs and negative impacts on your long-term financial health.

How Your Wedding Budget Gets Smarter

Traditional Approach

High-interest credit cards, depleted savings, or family loans create financial stress and post-wedding high rate debt that can last for years.

Long-Term Advantage

Your wedding is paid for through structured payments, while your retirement savings continue to grow. You enjoy both the celebration and financial security.

TravelRSP Difference

Access retirement funds without penalties, receive immediate tax benefits, and maintain your retirement growth trajectory.

How Your Wedding Budget Gets Smarter

Traditional Approach

High-interest credit cards, depleted savings, or family loans create financial stress and post-wedding high rate debt that can last for years.

TravelRSP Difference

Access retirement funds without penalties, receive immediate tax benefits, and maintain your retirement growth trajectory.

Long-Term Advantage

Your wedding is paid for through structured payments, while your retirement savings continue to grow. You enjoy both the celebration and financial security.

CRA-Compliant & Secure

Popular Destination Wedding Locations

WeddingRSP has helped Canadian couples celebrate in stunning locations worldwide while maintaining their financial health. Our wedding planners coordinate with financial advisors to optimize both your celebration and your savings.

Our Wedding Planning Partners

130+

Location

Destination Weddings

Successfully planned and funded through our innovative RRSP strategy across six continents.

No Limits

Wedding Budget

Total wedding expenses funded through WeddingRSP in the past year alone, with zero early withdrawal penalties.

Five Star

Client Satisfaction

Nearly all clients report they would recommend our unique financial-wedding planning approach to friends and family.

How Much Can You Access?